Hotel reit index images are ready. Hotel reit index are a topic that is being searched for and liked by netizens now. You can Find and Download the Hotel reit index files here. Get all royalty-free images.

If you’re looking for hotel reit index images information connected with to the hotel reit index interest, you have visit the ideal site. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly search and locate more informative video articles and graphics that match your interests.

Following a record year for the industry in. HST saw a 20 increase in RevPAR in 2018 and expects similar growth in 2019. Nareits members are REITs and other real estate companies throughout the world that own operate and finance income-producing real estate as well as those firms and individuals who advise study and service those businesses. Real estate investment trusts or REITs typically specialize in a single type of real estate asset. DJUSHL A complete Dow Jones US.

Hotel Reit Index. Throw in the towel on buying REITs directly and buy an index fund which mixes lots of different REITs including hotel REITs as part of a diversified portfolio. Nareits members are REITs and other real estate companies throughout the world that own operate and finance income-producing real estate as well as those firms and individuals who advise study and service those businesses. Host Hotels Resorts HST-The largest publicly traded Hotel REIT by market cap HST owns premium luxury hotels in prime locations. BBG US REITs Index is a capitalization-weighted index of Real Estate Investment Trusts having a market capitalization of 15 million or greater.

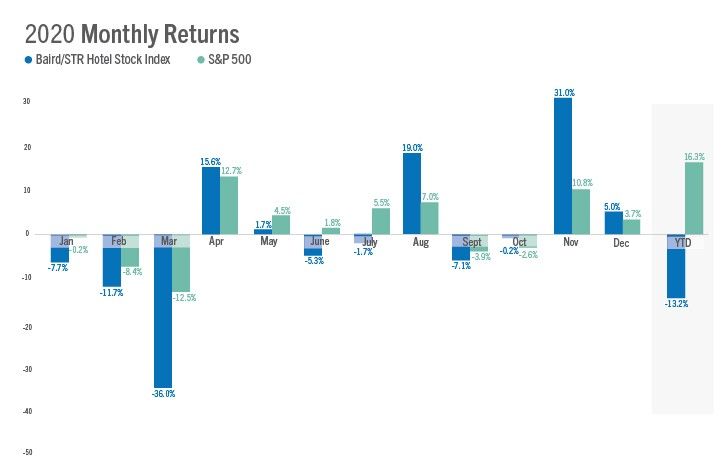

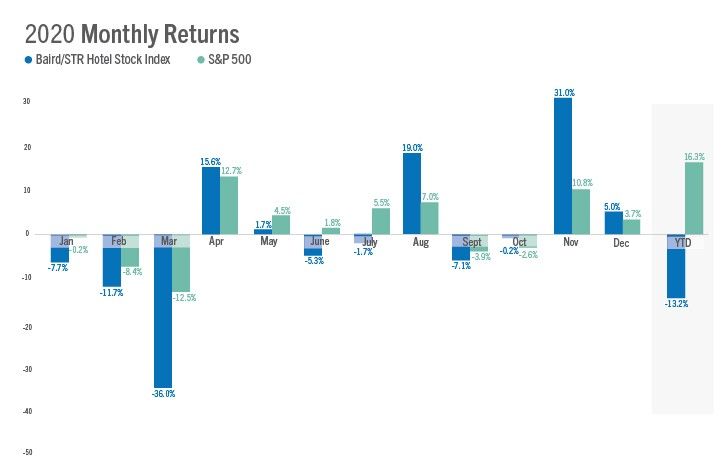

Hotel Stock Index Up 5 Percent In December Asian Hospitality From asianhospitality.com

Hotel Stock Index Up 5 Percent In December Asian Hospitality From asianhospitality.com

22 American Tower AMT 21419 is a leader in telecommunications infrastructureThis REIT owns a global portfolio of 181000 cell towers including. KBS Real Estate Investment Trust II Inc. Xenia Hotels Resorts Inc. Buy via an index fund. Following a record year for the industry in. Nareits members are REITs and other real estate companies throughout the world that own operate and finance income-producing real estate as well as those firms and individuals who advise study and service those businesses.

Its really important as a REIT investor whether youre talking about retail hotels hospitality to know there is a bunch of different levels of these properties and when theyre going to come.

80 assets are in the US while 5 are located internationally. Park Hotels and Resorts PK-52. Throw in the towel on buying REITs directly and buy an index fund which mixes lots of different REITs including hotel REITs as part of a diversified portfolio. Nareit serves as the worldwide representative voice for REITs and real estate companies with an interest in US. KBS Real Estate Investment Trust II Inc. Nareits members are REITs and other real estate companies throughout the world that own operate and finance income-producing real estate as well as those firms and individuals who advise study and service those businesses.

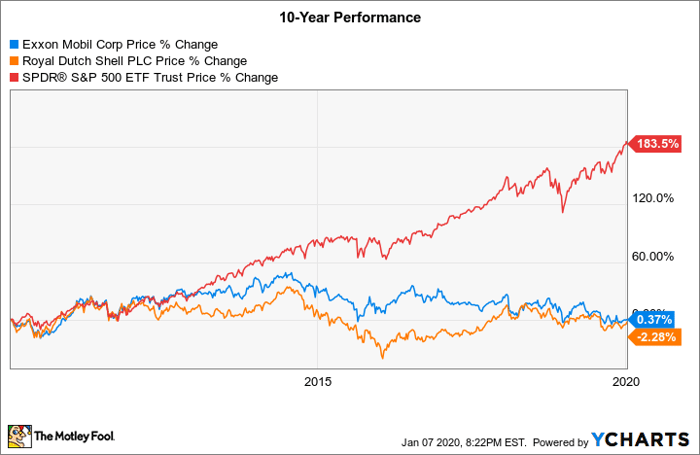

Source: fool.com

Source: fool.com

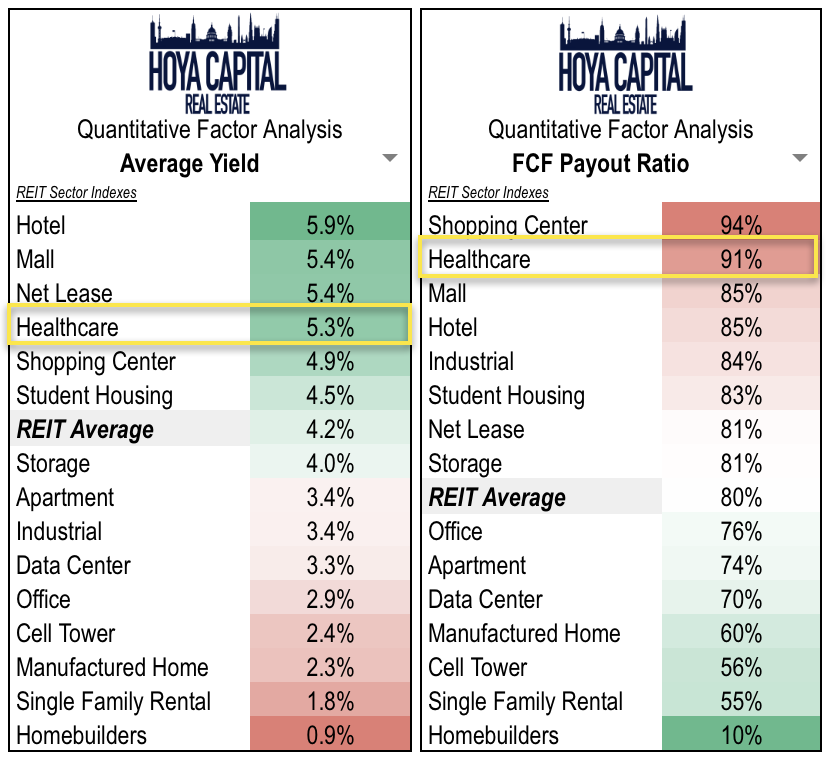

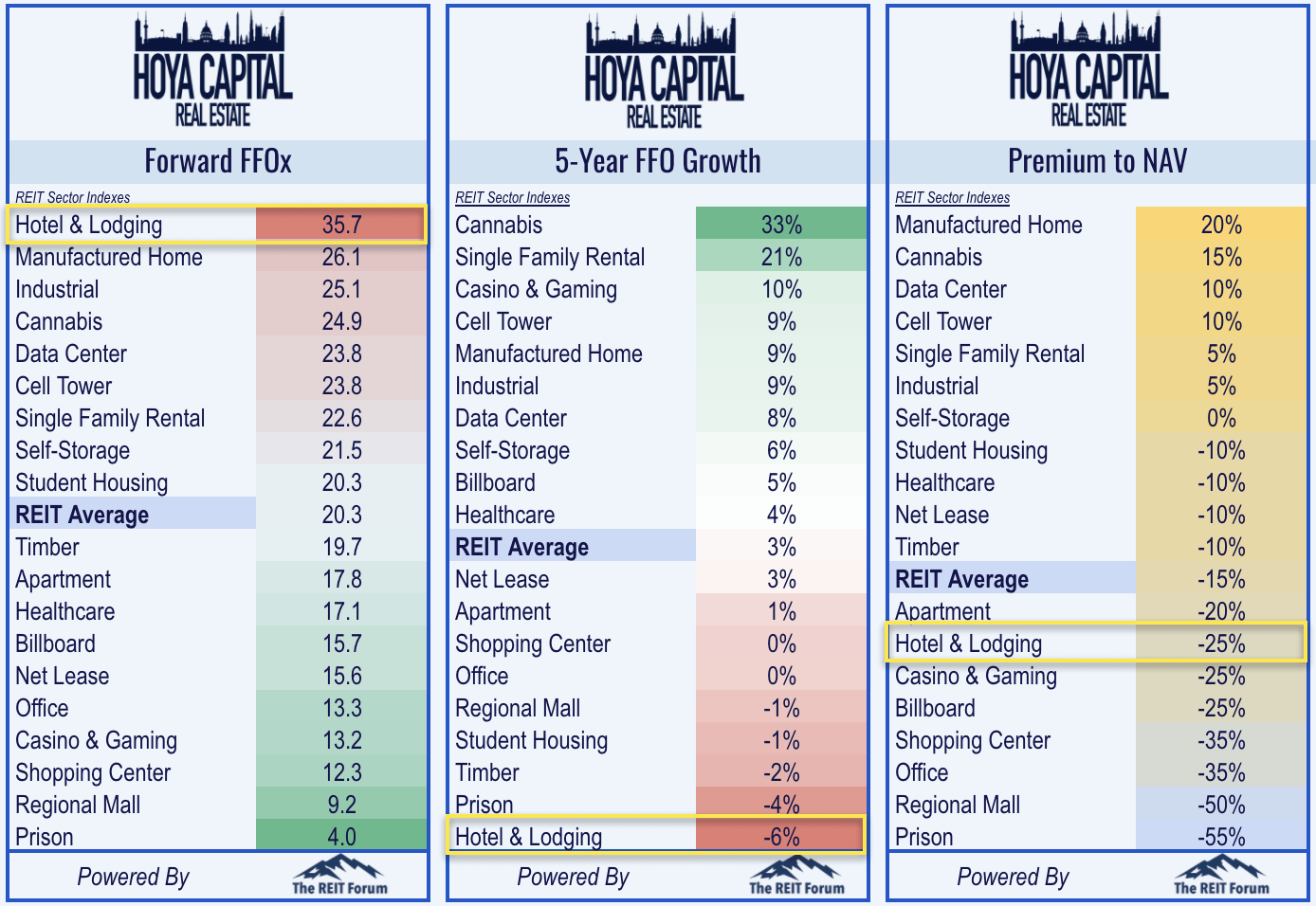

Following a record year for the industry in. The hotel index is the only REIT sector in negative territory over the prior 52 weeks down 8 compared to the broader REIT sector which has gained over 17. Also surprising is the significant. BBG US REITs Index is a capitalization-weighted index of Real Estate Investment Trusts having a market capitalization of 15 million or greater. Host Hotels Resorts HST-The largest publicly traded Hotel REIT by market cap HST owns premium luxury hotels in prime locations.

Source: spglobal.com

Source: spglobal.com

BBG US REITs Index is a capitalization-weighted index of Real Estate Investment Trusts having a market capitalization of 15 million or greater. Landmark Infrastructure Partners LP. Its really important as a REIT investor whether youre talking about retail hotels hospitality to know there is a bunch of different levels of these properties and when theyre going to come. DJUSHL A complete Dow Jones US. With a market capitalization of 203 million Braemar Hotels Resorts is a conservatively capitalized REIT that invests primarily in high revenue per available room RevPAR full-service luxury.

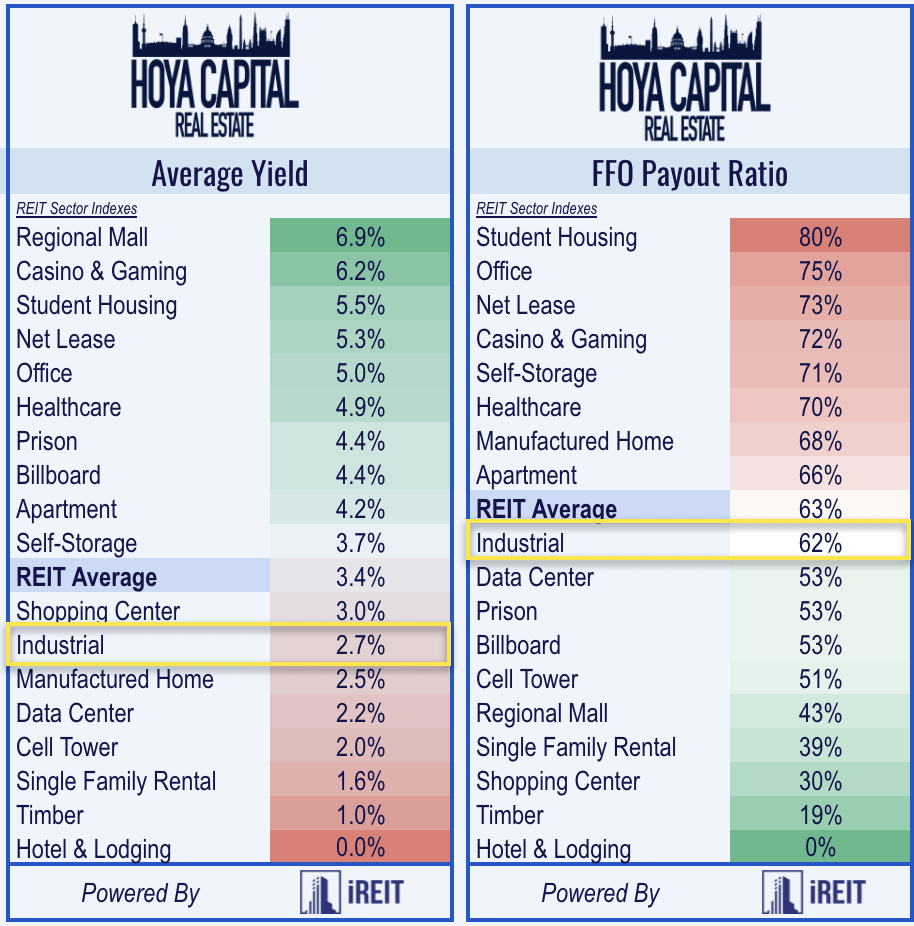

Source: seekingalpha.com

Source: seekingalpha.com

22 American Tower AMT 21419 is a leader in telecommunications infrastructureThis REIT owns a global portfolio of 181000 cell towers including. Also surprising is the significant. BBG US REITs Index is a capitalization-weighted index of Real Estate Investment Trusts having a market capitalization of 15 million or greater. 80 assets are in the US while 5 are located internationally. The hotel index is the only REIT sector in negative territory over the prior 52 weeks down 8 compared to the broader REIT sector which has gained over 17.

Source: seekingalpha.com

Source: seekingalpha.com

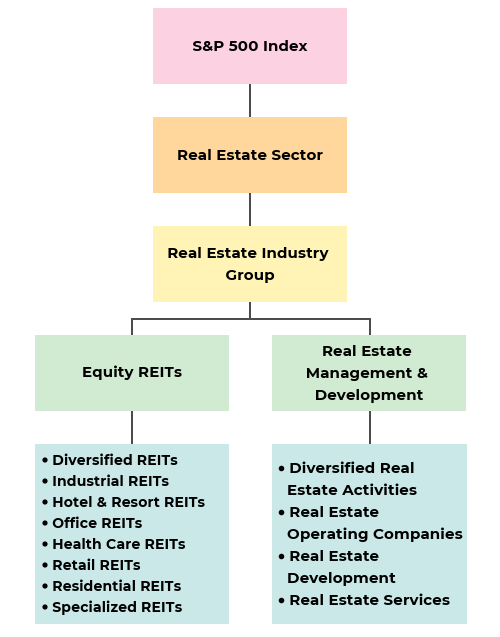

KBS Real Estate Investment Trust II Inc. The Vanguard REIT Index Fund follows the MSCI US REIT Index an index that tracks domestic equity real estate investment trusts REITs and firms that manage properties and collect rent. Real estate investment trusts or REITs typically specialize in a single type of real estate asset. 22 American Tower AMT 21419 is a leader in telecommunications infrastructureThis REIT owns a global portfolio of 181000 cell towers including. Hotel Lodging REIT Index index overview by MarketWatch.

Source: asianhospitality.com

Source: asianhospitality.com

The company previously paid a quarterly cash. Nareits members are REITs and other real estate companies throughout the world that own operate and finance income-producing real estate as well as those firms and individuals who advise study and service those businesses. Hotel Lodging REIT Index index overview by MarketWatch. With a market capitalization of 203 million Braemar Hotels Resorts is a conservatively capitalized REIT that invests primarily in high revenue per available room RevPAR full-service luxury. CatchMark Timber Trust Inc.

Source: seekingalpha.com

Source: seekingalpha.com

View stock market news stock market data and trading information. Also surprising is the significant. DJUSHL A complete Dow Jones US. Using total returns as a measure hotel REITs have still lost about 8 more value since the start of the year than office REITs on the whole according to Nareit data. The hotel REIT sector represents a total enterprise value of 800 billion with a commercial market capitalization of 465 billion and represents 39 to 44 of the FTSE REIT and MSCI REIT.

Source: seekingalpha.com

Source: seekingalpha.com

Its really important as a REIT investor whether youre talking about retail hotels hospitality to know there is a bunch of different levels of these properties and when theyre going to come. The hotel index is the only REIT sector in negative territory over the prior 52 weeks down 8 compared to the broader REIT sector which has gained over 17. Nareit serves as the worldwide representative voice for REITs and real estate companies with an interest in US. The company previously paid a quarterly cash. Appreciation in asset values growth in earnings and dividend distributions is their value proposition to shareholders.

Source: dividend.com

Source: dividend.com

80 assets are in the US while 5 are located internationally. Nareit serves as the worldwide representative voice for REITs and real estate companies with an interest in US. 955 billion Dividend yield. DJUSHL A complete Dow Jones US. The Vanguard REIT Index Fund follows the MSCI US REIT Index an index that tracks domestic equity real estate investment trusts REITs and firms that manage properties and collect rent.

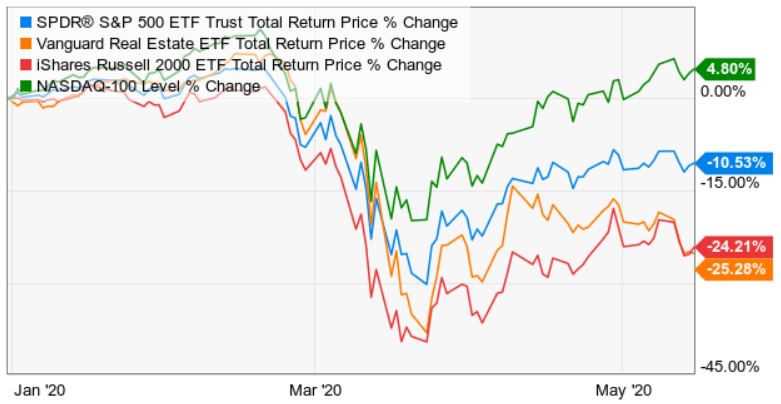

Source: spglobal.com

Source: spglobal.com

HST saw a 20 increase in RevPAR in 2018 and expects similar growth in 2019. HST saw a 20 increase in RevPAR in 2018 and expects similar growth in 2019. Landmark Infrastructure Partners LP. This technique has a much lower dividend yield but if you think the reduced risk is worth that trade-off it might be your wisest course of action. With a market capitalization of 203 million Braemar Hotels Resorts is a conservatively capitalized REIT that invests primarily in high revenue per available room RevPAR full-service luxury.

Source: seekingalpha.com

Source: seekingalpha.com

The hotel index is the only REIT sector in negative territory over the prior 52 weeks down 8 compared to the broader REIT sector which has gained over 17. DJUSHL A complete Dow Jones US. KBS Real Estate Investment Trust III. Park Hotels and Resorts PK-52. HST saw a 20 increase in RevPAR in 2018 and expects similar growth in 2019.

Source: seekingalpha.com

Source: seekingalpha.com

Nareit serves as the worldwide representative voice for REITs and real estate companies with an interest in US. KBS Real Estate Investment Trust III. The Northeast Hotel Investment Forum LATEST INFO Boston - Tuesday January 14 2020- Revere Hotel Boston Common LATEST PHOTOS The Northwest Hotel Investment Forum LATEST INFO Thursday October 17 2019 400-730 pm in Seattle Washington LATEST PHOTOS February 2019 in Vail Colorado Sandman Savrann 9th Annual Powder Summit LATEST INFO LATEST. This technique has a much lower dividend yield but if you think the reduced risk is worth that trade-off it might be your wisest course of action. 955 billion Dividend yield.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hotel reit index by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.